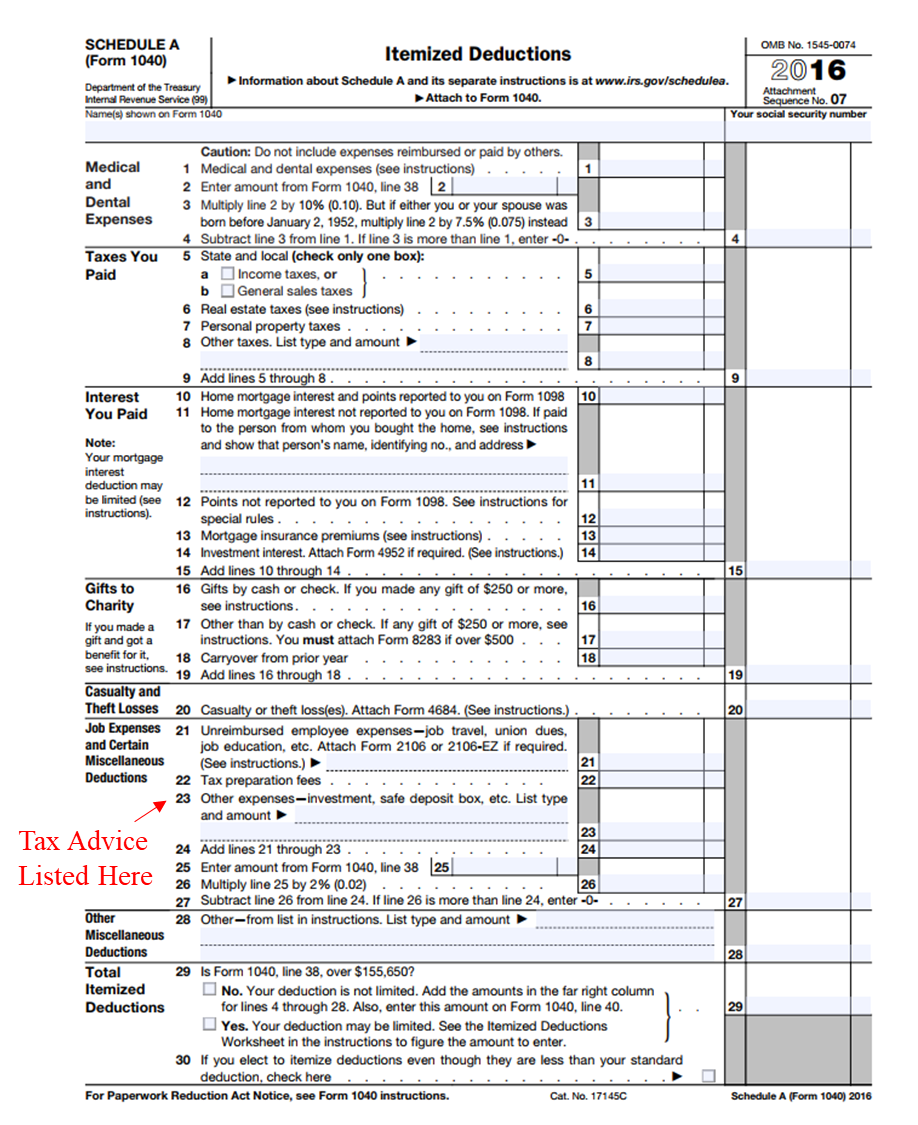

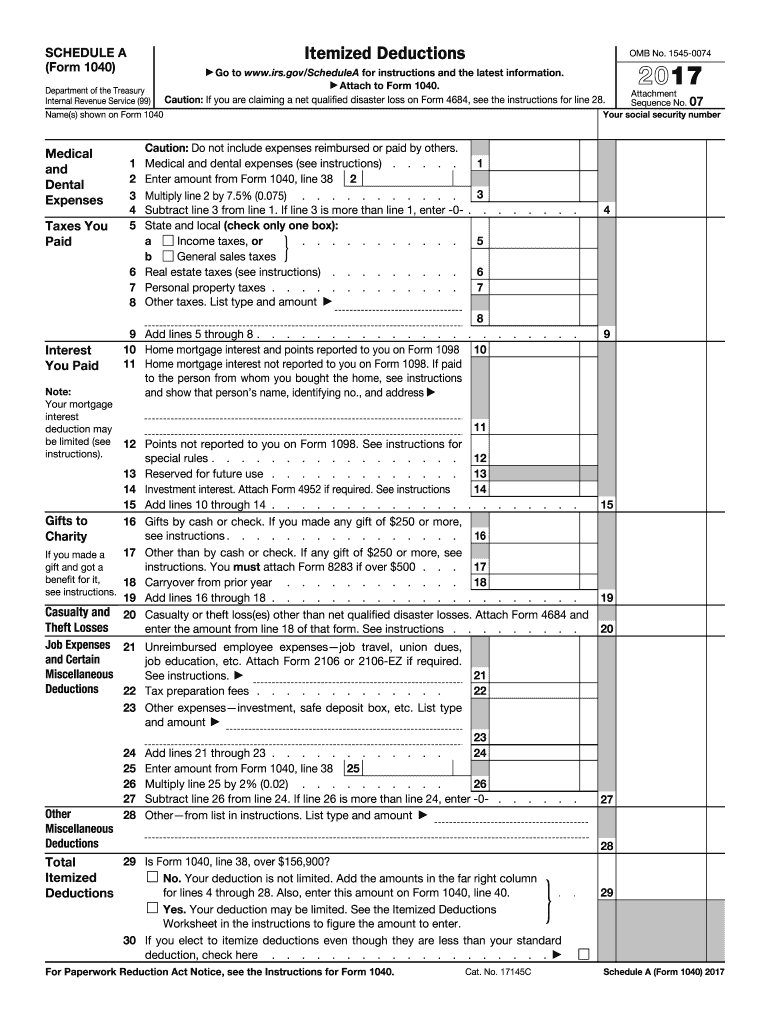

Miscellaneous itemized deductions subject to 2 floor deductions for certain professional fees licenses union etc investment expenses and unreimbursed employee expenses have been suspended.

Irs itemized deductions floor.

Deductible expenses subject to the 2 floor includes.

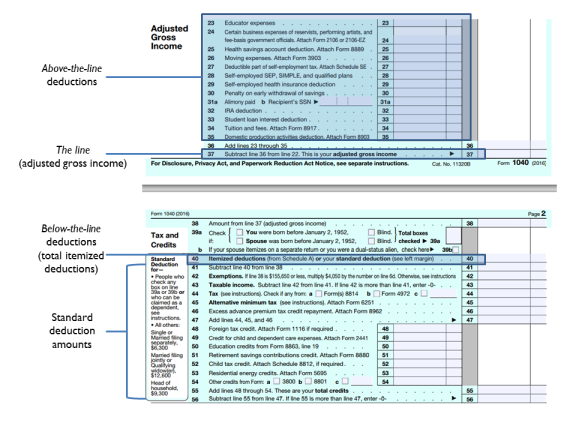

20 2 itemized deductions itemized deductions include amounts paid for qualified.

There are several miscellaneous deductions that used to fall under the 2 percent rule meaning you could only deduct the amount within each category that exceeds 2 percent of agi.

Expenses for uniforms and special clothing.

In the case of an individual the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceeds 2 percent of adjusted.

Also included is tax preparation fees and safety deposit box fees.

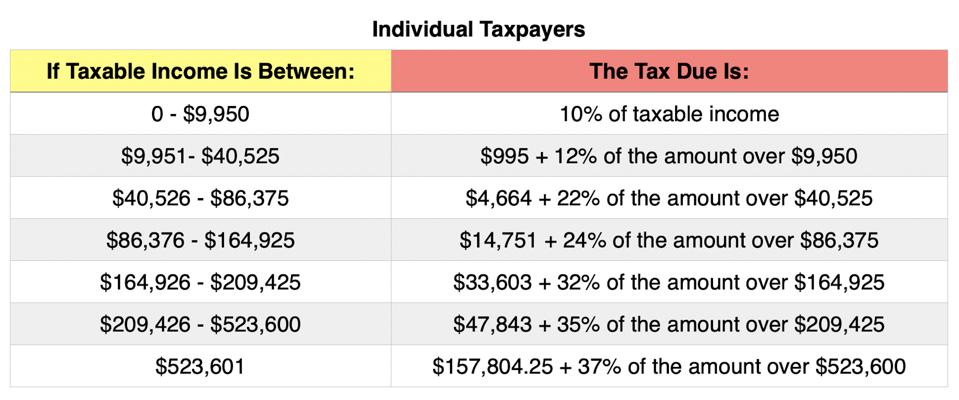

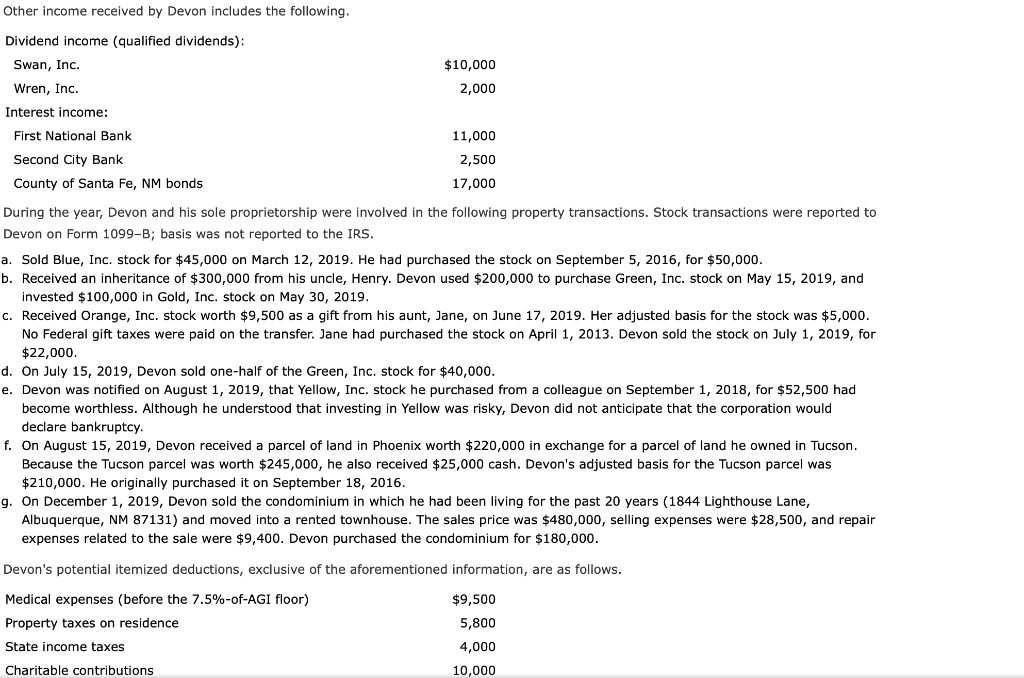

This goes up to 24 800 if you re married and filing jointly with your spouse or if you re a qualifying widow or widower with a dependent child.

As of the 2020 tax year the return you ll file in 2021 the standard deduction is 12 400 for single taxpayers and for those who are married but filing separate returns.

In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

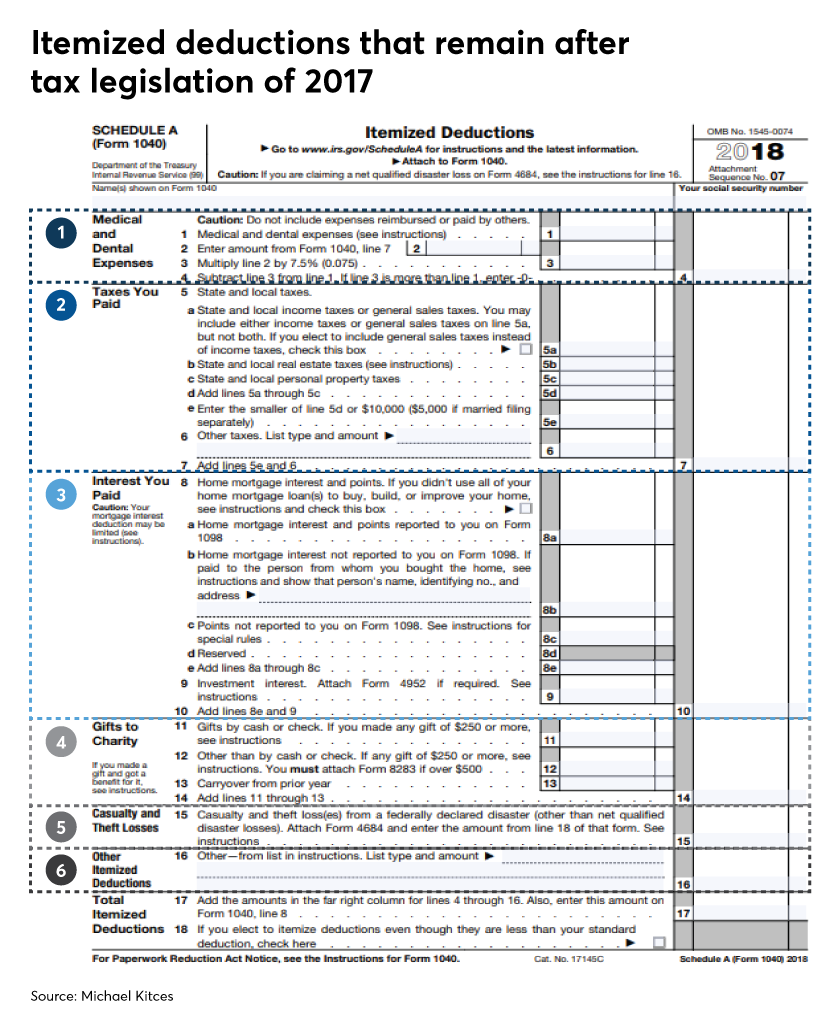

Starting on january 1 2018 and running through december 31 2026 individuals will no longer have the ability to deduct the excess expenses listed below as itemized deductions on their 1040s.

Caps are meant to reduce the extent that tax provisions can distort economic behavior.

As we mentioned earlier you can only deduct medical and dental expenses that exceed 10 percent of adjusted gross income agi.

This includes mileage and the home office deduction for w 2 employees.

Code 67 2 percent floor on miscellaneous itemized deductions.

Total expenses less than this floor are not eligible for an itemized deduction 4 in addition some itemized deductions are subject to a cap also known as a ceiling in benefits or eligibility.

Unreimbursed employee business expenses such as.

Use schedule a form 1040 or 1040 sr to figure your itemized deductions.

For most americans we ll discuss some special deductions later on there are just a few itemized deductions that are still available.

Job expenses and miscellaneous deductions subject to 2 floor.